Traversing the Labyrinth : Your Ultimate Manual to Car Protection

Auto insurance can often feel similar to a difficult labyrinth, leaving many motorists overwhelmed by the myriad of decisions and terminology. Whether you are a inexperienced buyer or considering to change providers, comprehending the ins and outs of car insurance is essential for shielding yourself and your vehicle on the road. This guide is crafted to help you maneuver the intricacies of car insurance, making the process easier and more manageable.

With many policies, coverage options, and prices available, it's vital to equip yourself with the knowledge needed to make wise decisions. From third-party coverage to accident and comprehensive options, knowing what the terminology means and how it applies to your circumstances can save you hours and costs. By breaking down the fundamentals of car insurance, this guide will empower you to find the right policy customized to your needs.

Comprehending Car Coverage Basics

Auto insurance is a policy between you and an insurance provider that supplies monetary security in the scenario of an incident, robbery, or destruction to your automobile. By submitting a payment, you are protected for certain costs associated with car-related incidents. Understanding the basics of auto coverage is vital for choosing the appropriate plan and making sure you have proper insurance for your needs.

There are different types of insurance options within car insurance, including liability coverage, impact coverage, and comprehensive coverage. Liability coverage helps cover damages to other people and their property if you are at blame in an accident. Collision insurance pays for repairs to your own vehicle after an accident, while comprehensive coverage defends against non-collision incidents like robbery or calamities. Knowing the distinctions between these types can help you reach educated judgments.

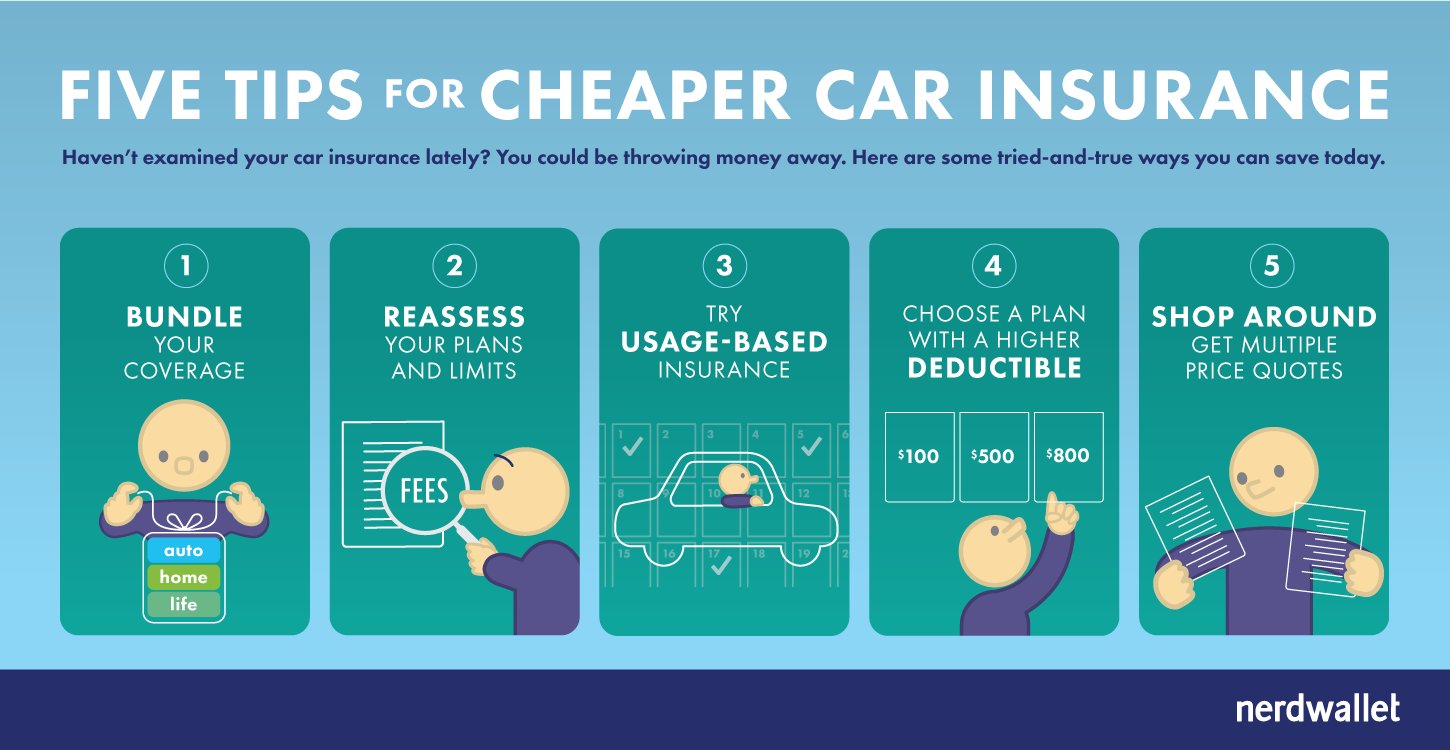

When selecting a car insurance agreement, it is essential to take into account factors like policy limits, deductibles, and savings. Increased policy limits may give better protection but could lead to elevated payments. Out-of-pocket expenses are the sum you pay out of pocket before the policy activates, and choosing a larger deductible can reduce your cost. Various providers also provide reductions for clean driving records, combined plans, or reduced mileage, which can further lower your overall costs.

Types of Auto Insurance Coverage

While contemplating car insurance, it's crucial to know the multiple types of coverage available. The most prevalent form is liability coverage, which is commonly required by law. This coverage shields you if you are found to be at fault in an accident, including bodily injuries and property damage to others. It is vital to have sufficient liability limits to shield your assets in case of a major claim.

Another, essential type of coverage is collision coverage. This pays for the repairs to your vehicle after an accident, irrespective of who caused it. If your car is damaged in a collision, you can make a claim under this coverage to get back on the road faster. While not mandatory, collision insurance is wise for drivers with newer or higher-value vehicles who want to defend their investment.

Comprehensive insurance is also a key part of auto insurance coverage. It shields against non-collision incidents, such as theft, vandalism, or natural disasters. very cheap car insurance no deposit texas of insurance ensures you're covered for damages not caused by a collision, providing peace of mind for unexpected events. Combining comprehensive with liability and collision creates a complete insurance plan that defends you and your vehicle on the road.

Suggestions for Selecting the Appropriate Coverage

When selecting a auto insurance policy, it is crucial to assess your insurance requirements based on your driving habits, the type of vehicle you own, and your available funds. Consider items such as whether you drive your car regularly, how often you face difficult conditions, and the longevity and worth of your vehicle. Tailoring your policy to fit these factors will help you prevent paying for excess coverage while guaranteeing you are properly protected.

It is also important to contrast different insurers and their offerings. Make an effort to examine various providers to grasp their reputation, service history, and claims process. Many websites allow you to request quotes from multiple insurers, making the process of evaluation easier. Seek out savings that may apply, including clean driving history or combining auto insurance with other insurance plans. Each provider has its unique strengths, so shop around to discover the best fit for your situation.

Ultimately, be sure to review the fine print of the policy you are looking at. Comprehending the provisions, conditions, and restrictions is crucial to make sure you know what is covered and what is not included. Focus on the out-of-pocket costs, caps, and any additional add-ons that may be required for your particular situation. Taking the time to carefully examine the policy specifications will help avoid surprising costs down the road and give comfort while driving.