Increase Your Savings Account: Strategies for Reducing Car Coverage Expenses

Finding methods to cut expenses is always a priority, particularly especially it comes to required expenses like auto insurance. Vehicle insurance is not just a required duty in many places, and it also provides vital protection for you and the vehicle. Yet, the costs can quickly add up, leaving many drivers seeking effective strategies to reduce their rates without losing coverage.

Thankfully, there are several useful tips that can guide you enhance your cost savings on car insurance. From shopping around for more competitive rates to utilizing discounts, making wise choices can lead to significant savings. In this resource, we will explore various methods you can utilize to ensure you are not spending excessively for your vehicle insurance, letting you to retain extra funds in the pocket while still enjoying the comfort that comes with having adequate coverage. ## Understanding Car Insurance Pricing

Car insurance costs are established by a range of elements that can considerably impact the amount you pay. Insurance companies consider individual information such as your how old you are, sex, and driving background. For instance, drivers under a certain age or those with a record of incidents or penalties may experience increased costs due to the perceived risk. Additionally, the kind of automobile you operate plays a crucial role; sports cars often come with elevated insurance costs.

Another key consideration in determining your auto insurance premiums is your geographic area. Metropolitan regions with greater vehicle density often lead to increased rates, as the chance of collisions is higher. In comparison, less populated regions may have diminished rates due to less frequent accident frequency. Additional local elements, including crime rates and weather patterns, can also alter your total premium costs.

Finally, the coverage options you opt for and your chosen deducted amount can greatly impact your insurance premiums. Comprehensive coverage, which encompasses a wider range of protections, will likely cost more than a basic policy. Additionally, selecting a higher deductible can reduce your periodic premium, but it also means you'll pay extra out of pocket in the instance of a claim. Comprehending these factors can help you arrive at knowledgeable choices about your car insurance to in the end decrease your expenses.

Advice to Reduce Your Premium

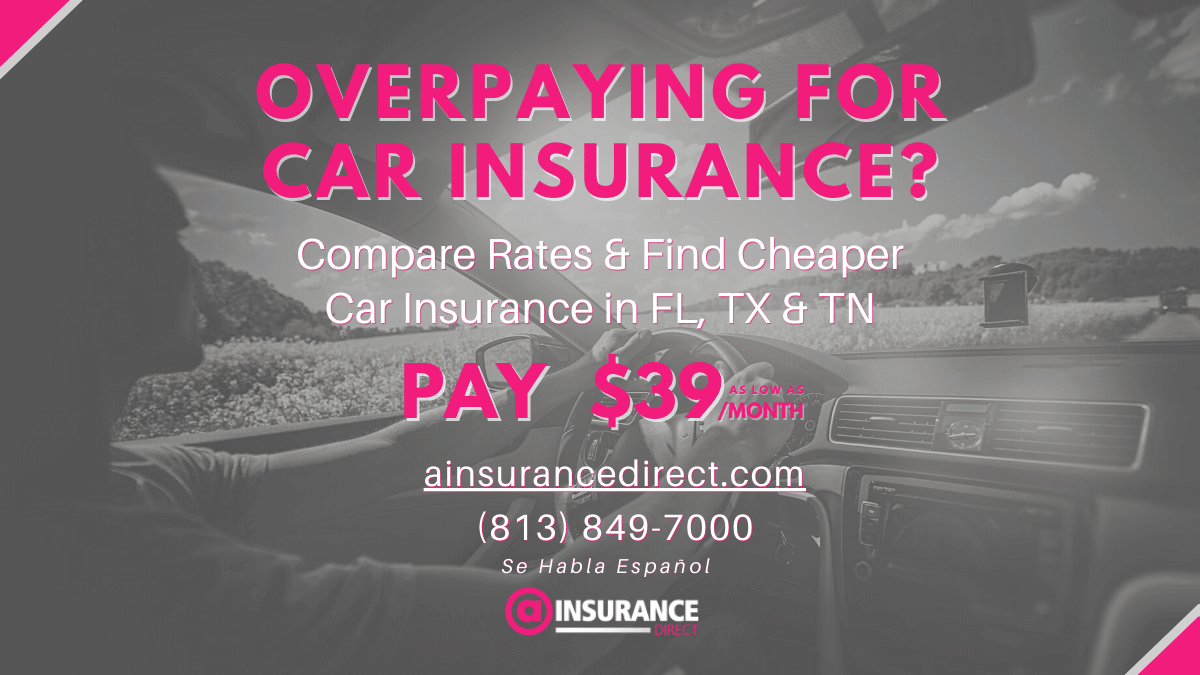

One efficient way to lower your car insurance rates is to shop around and contrast quotes from various providers. Several insurance companies have different rates and discounts, so it is wise to take the time to investigate and find the optimal deal. Make use of online comparison tools or work with an insurance agent who can help you through your options and ensure you are obtaining the best coverage for your financial situation.

An additional approach is to enhance your deductible. By opting for a greater deductible, you can significantly lower your monthly premium. However, it is important to ensure that you can comfortably afford the deductible in the event of a claim. Balancing a higher deductible with your financial situation can lead to lower expenses while still providing you with appropriate protection.

In conclusion, consider taking advantage of available discounts. Numerous insurers offer discounts for multiple reasons, such as having a good driving record, bundling multiple policies, or being a participant of specific organizations. Engaging with your insurance provider to ask about all possible savings can help you maximize savings opportunities, making your auto insurance more cost-effective.

Evaluating Coverage Choices

When thinking about car insurance, it's crucial to assess the insurance options available to you. Start by understanding the different types of coverage, such as liability, collision, and comprehensive insurance. Liability coverage is typically required by law and safeguards you if you're at fault in an accident. Collision coverage helps pay for loss to your car after an accident, while comprehensive coverage covers against non-collision incidents including theft or natural disasters.

Then, consider your personal needs and driving habits. If you have an older vehicle, you may want to reconsider whether collision and comprehensive coverage are necessary, as the premiums may outweigh the car's value. Conversely, if you drive regularly or have a new car, higher coverage limits could provide reassurance. Additionally, think about your financial situation and what you can afford in terms of deductibles and out-of-pocket expenses in the case of a claim.

Finally, always compare quotes from multiple providers when assessing coverage options. car insurance near me open now can vary significantly between insurance companies, and discounts may be available based on factors like good driving records or bundling policies. Taking the time to shop around ensures you find the best policy that fulfills your coverage needs while aiding you save on costs.