Exploring the Complexity of Automobile Coverage: Guidelines and Hacks

Auto insurance can often feel like a complicated maze, filled with a variety of options, terms, and regulations. For many drivers, understanding how to effectively navigate this labyrinth is essential not only for compliance but also for ensuring they get the optimal coverage at the most affordable rates. Whether you are a new driver or have been on the road for a long time, the process of selecting car insurance can be daunting.

In this manual, we strive to demystify auto insurance by providing you with practical tips and tricks to help you make informed decisions. From understanding the various types of coverage to learning how to compare quotes, we will provide you with the knowledge you need to tackle the intricacies of car insurance with assurance. With the right information, you can safeguard yourself and your vehicle without breaking the bank.

Grasping Vehicle Insurance Fundamentals

Car insurance is a agreement between car proprietor and a coverage provider that provides monetary protection in the case of collisions or damages involving the insured vehicle. Vehicle insurance usually covers a range of scenarios such as liability for harm to others, damage to assets, and individual wound protection. Grasping the coverage choices available is important for choosing the right policy that fits your requirements.

There are different kinds of coverage that make up a comprehensive auto insurance policy. Liability coverage is mandatory in most states and protects against damages or injuries that you inflict to others in an accident. Collision insurance helps pay for fixes to your own vehicle after an accident, while comprehensive coverage covers non-accident incidents such as theft or vandalism. Extra choices may include uninsured motorist coverage and health expenses insurance.

When shopping for vehicle coverage, it's crucial to assess your specific requirements and compare estimates from various companies. Factors such as your motorist history, the kind of vehicle you possess, and your credit score can influence your premiums. Understanding how these elements interact can empower you to make informed decisions, eventually leading to improved insurance at a price that suits your financial plan.

Types of Car Insurance Coverage

Comprehending the various types of car insurance coverage is crucial for each vehicle owner. The most prevalent type is liability coverage, which is required in most states. This coverage covers losses to another person's property and healthcare costs if you are responsible in an accident. It helps secure your financial well-being in case you injure to others on the road.

Another vital type of coverage is collision insurance. This shields your vehicle in the instance of an accident, regardless of who is at fault. If you hit a vehicle or an obstacle, collision coverage will assist in covering repairs to your vehicle or, if it is written off, the actual cash value of the car. For those who have newer or more valuable cars, this coverage is often considered as a required.

Comprehensive coverage is also a crucial component of auto insurance. Unlike collision coverage, comprehensive insurance covers damage to your vehicle caused by non-collision events, such as robbery, vandalism, natural disasters, or hitting an animal. Many lenders and dealerships may ask for this coverage if you are taking out a loan on your vehicle, as it ensures protection against a broader spectrum of risks.

Elements Influencing Your Premium

One of the primary factors impacting your auto insurance premium is your driving history. Insurers typically consider how safe a driver you are by looking at your record of accidents, infractions, and payouts. A clear record with no accidents or tickets often yields lower premiums, while a record with multiple infractions can significantly increase your expenses. Therefore, maintaining a careful driving behavior is not only advantageous for your own safety but also for keeping your insurance costs reasonable.

Another significant element is the kind of vehicle you own. Different cars possess varying levels of danger associated with theft, safety scores, and maintenance expenses. High-performance vehicles often lead to higher rates due to their desirability and higher likelihood of being engaged in high-cost incidents. On the other hand, sedans with high safety features tend to attract lower insurance costs. When picking a vehicle, take into account how insurance rates will be affected by the car's manufacturer and model.

Finally, aspects such as your location and demographic information also play a major role in determining your premium. Urban areas typically have higher premiums due to greater congestion and a greater risk of accidents. Moreover, age, gender, and marital status can influence pricing, as younger drivers and males tend to face higher premiums due to statistical data demonstrating a higher risk of accidents. Comprehending these factors gives you clarity into how your personal choices and area can influence your auto insurance costs.

Evaluating Quotes obtained from Insurance Companies

In terms of car insurance, an effective method to obtain the most suitable coverage at the correct cost is to juxtapose estimates provided by various insurers. Every insurer has its own method of assessing risk and setting prices coverage options, meaning that charges can vary significantly for the same coverage. Start by creating a catalog of trustworthy companies and asking for rates based on the identical coverage levels. This will ensure a fair assessment and assist you in figure out the insurance companies provide the greatest offers.

In addition, it is important to consider the particulars in each estimate. Although one company may present a lower cost, the limits, deductibles, and restrictions can differ dramatically. Pay attention to the provided features, for example roadside assistance or rental car reimbursement, as these can boost a plan. Verify that you are juxtaposing like policies so that you can make an informed decision that balances both price and coverage.

Lastly, explore taking advantage of online comparison resources that facilitate the process of collecting estimates. Various sites allow you to input your data one time and obtain multiple quotes from varied insurance companies in no time. This not only is convenient but also makes it easier to see the differences between diverse coverage options. Don’t forget to look for any further reductions that may be available, as some companies provide reduced rates for factors like a clean driving record or package deals.

Typical Car Coverage Misconceptions

Many people hold assumptions about auto coverage that can lead to misunderstanding and potentially expensive mistakes. One common myth is that maintaining a clean driving record instantly guarantees the cheapest rates. While a clean record is advantageous and can lower your costs, insurers evaluate various elements such as your credit score, the type of vehicle you drive, and your where you live. Therefore, it is crucial to realize that while a clean record is beneficial, it is just one piece of the puzzle when determining your auto insurance costs.

Another frequent myth is that the color of your car can influence your insurance rates. Many individuals think that certain colored cars are more costly to cover, but this is simply not true. Auto insurance companies do not factor the color of the car into account when determining premiums. Instead, they focus on safety ratings, theft rates, and repair costs associated with different brands and models. So when choosing a car, focus on safety and reliability rather than its hue.

Lastly, some drivers think that coverage is unnecessary for aged vehicles. While it might look logical to drop full coverage on a car with a declining value, this strategy can lead to significant financial setbacks if the vehicle is involved in an accident. A comprehensive or collision policy could still be beneficial, especially if the car is in excellent shape or holds sentimental value. It’s important to consider the potential threats rather than solely focusing on the age of the vehicle.

Advice for Cutting Expenses on Auto Insurance

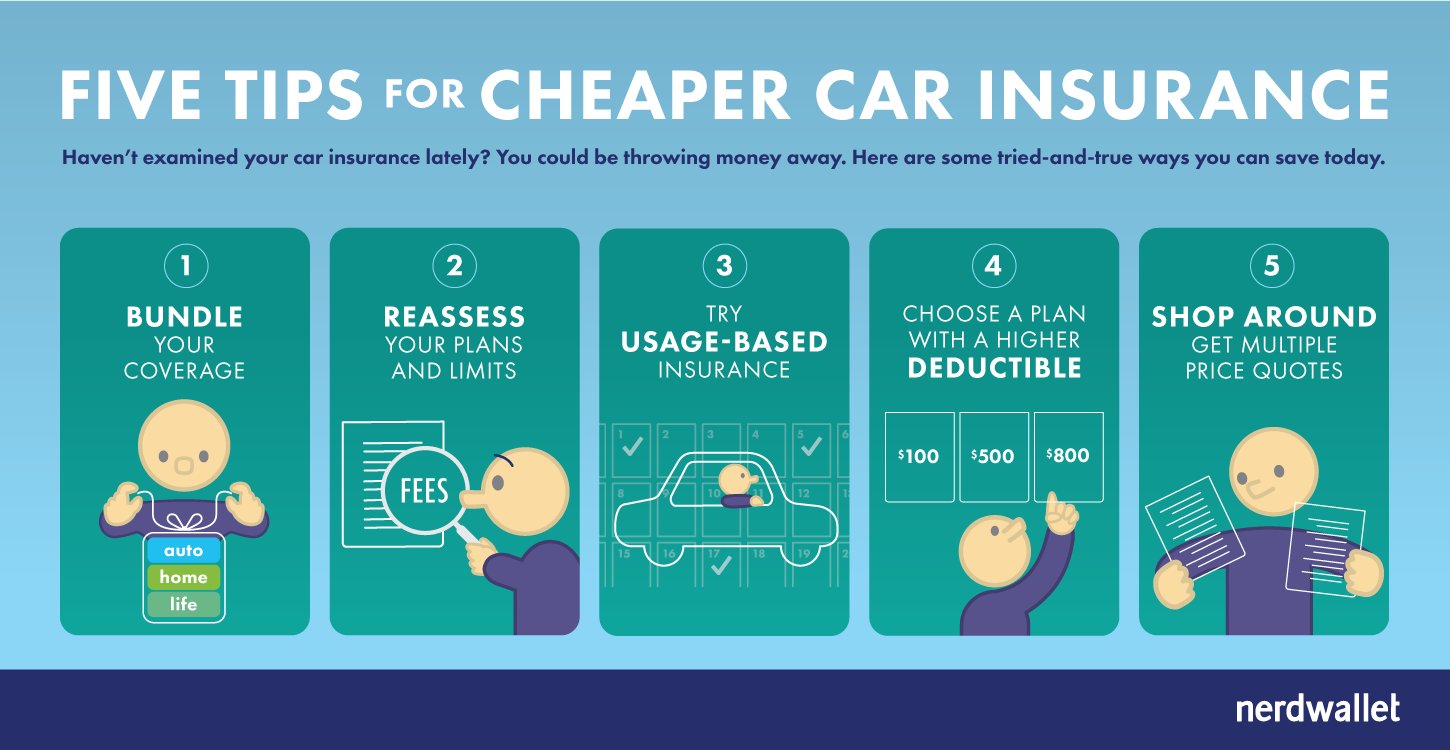

One great way to save on car insurance is to shop around and compare quotes from various providers. Prices can differ considerably between insurers, so investing time to compare can result in significant savings. Consider employing online comparison tools that allow you assess different policies and coverages at once. Additionally, ask about discounts for bundling multiple policies, such as auto and home insurance, which can frequently lower your overall premium.

Another strategy to minimize your auto insurance costs is to increase your deductibles. A larger deductible typically lowers your monthly premium but means you will incur higher costs in the case of a claim. It's important to pick a deductible that you can comfortably afford in case of an accident. Additionally, keeping a safe driving record and avoiding accidents can help keep your premiums down, as many insurers offer safe driver discounts.

Finally, consider reviewing your coverage needs from time to time. As cheapest car insurance Dallas change, like your car's value falling or changes in your mileage, you may be overspending on coverage. Changing your coverage or eliminating unnecessary add-ons can result in substantial savings. Consistently stay informed about new discounts and opportunities offered by your insurer, as these can vary often and may provide additional ways to save on your auto insurance.